Summary

This piece describes a quirky situation I've encountered in which I need to increase my annual income in order to be eligible for a US tax credit. It's mainly a reference for myself and may not be of wide interest.

Introduction

In Oct. 2013, I retired from Microsoft to work full-time on my charity, the Foundational Research Institute. Between then and when I'm writing this piece (Apr. 2016), I've earned only a few thousand dollars of income from employment, and the rest of my income has come from interest, dividends, and sales of stocks.

In 2014, after no longer having access to employer-sponsored health insurance, I applied for insurance using the New York State health-insurance marketplace, which was debuting that year following passage of the Affordable Care Act. Due my virtually nonexistent income, I was technically eligible for Medicaid, but I avoided signing up for that at the request of someone who thought it was unfair to take money that's supposed to go toward people who actually can't support themselves.

2014 taxes

During 2014, I had ~$20K of income from dividends and dealing with a stock rights issue. Fortunately, when all was said and done, I didn't end up paying much in taxes, and I also got ~$1500 back from the IRS due to the Premium Tax Credit, which compensates low-income people for how much more they pay for health insurance than what they "should" pay, relative to some definition of what they should pay.

2015 taxes

In 2015, I assumed I'd get the Premium Tax Credit again, but I didn't. I wondered if TurboTax was making a mistake in telling me that I wasn't eligible. But after further poking around, I discovered that TurboTax was correct. I wasn't eligible because my income was too low this year. Unlike in 2014, I didn't have a lot of income from stock transactions. As a result, my income was below the Federal Poverty Level (FPL), which in 2015 was $11,770. And "To be eligible for the premium tax credit, your household income must be at least 100, but no more than 400 percent of the federal poverty line for your family size." So I was earning too little in 2015 to get the tax credit.

Medicaid Gap

The situation where people earn too little for a Premium Tax Credit is a problem in some states that haven't expanded Medicaid. New York has expanded Medicaid, and I just hadn't signed up for it.

Actually, in states that have expanded Medicaid (including New York), it looks like tax-credit eligibility starts at 138% of the FPL, not 100%.

Solution: Increase my income

Unless I sign up for Medicaid (which would be a hassle due to the paperwork required when changing doctors and would contradict the original motivation for not signing up in the first place), I can get back the Premium Tax Credit by mimicking what happened in 2014: I can increase my income above 138% of the FPL. The easiest way to do this is to sell stocks with capital gains and then buy new stocks with the resulting cash. This has the bonus that it gives me a higher cost basis on my stocks, reducing future capital-gains taxes in the event that I ever start earning more in subsequent years.

In 2016, the FPL will be "$11,880 for individuals". So this suggests that my income (specifically, my MAGI, which is typically equal to my AGI) should be at least 1.38 * $11,880 = $16,394.4.

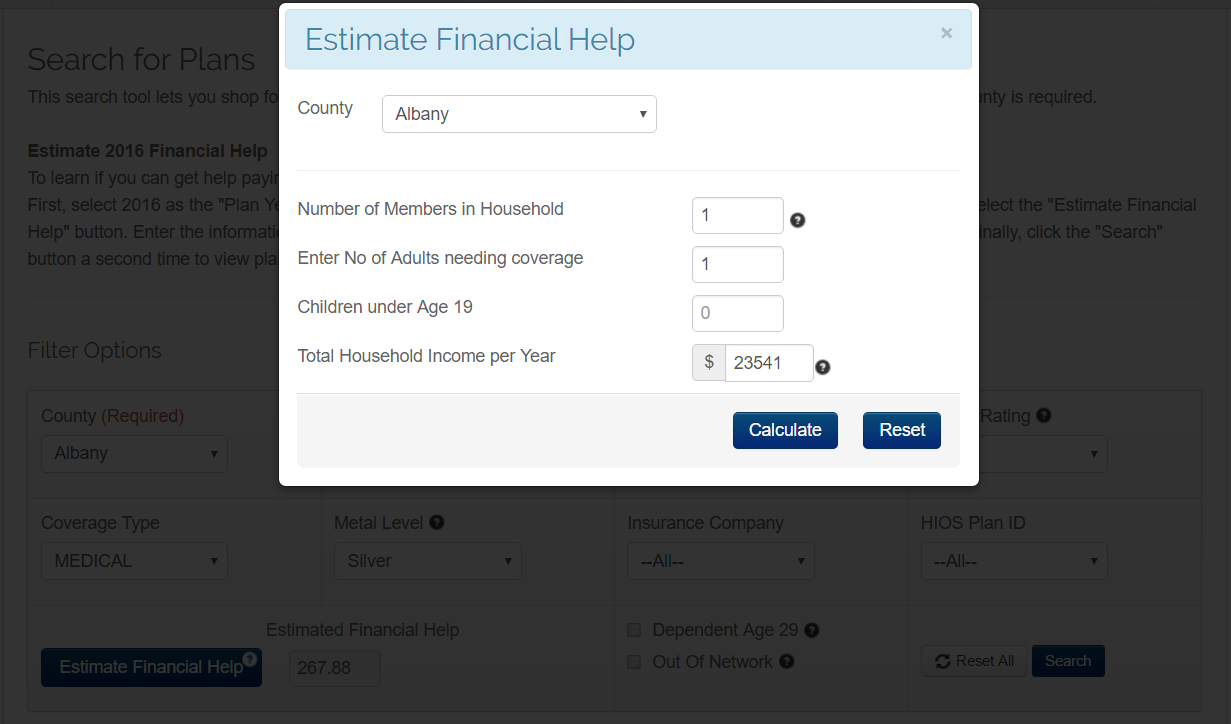

NY State of Health has its own calculator of eligibility for financial help, but for some reason, it says I would need to earn at least $23,541 before getting any assistance:

This amount seems to be double the 2015 FPL: 2 * $11,770 = $23,540. But I don't know why its double the FPL if New York Medicaid eligibility stops at 138% of the FPL. Plus, I didn't earn this much in 2014, yet I still got the tax credit that year.

So I'm not sure which income amount I need to exceed to get the tax credit. The $23,541 cutoff is $7,146.6 more than the $16,394.4 cutoff. And since I pay New York state income tax on all capital gains, increasing my income to the higher amount would incur an extra ~$475 of New York income tax (and would also lower my tax credit if the cutoff is indeed the lower one). That said, I wouldn't really pay extra federal tax by going to the higher income amount because my income would come from long-term capital gains, and the federal tax rate on those is 0% until one reaches the 25% tax bracket, which starts at $37,650 in 2016.

Unless I figure out the right answer, I'll probably shoot for the lower income cutoff ($16,394.4) and then learn whether that was the right choice for future years. [UPDATE, 17 Mar. 2017: Based on doing my 2016 taxes, I think the lower income cutoff probably is indeed correct.]

Capital losses subtract from capital gains, so it would be counterproductive to do tax-loss harvesting while following this strategy, and indeed, in 2016, I need to generate enough capital gains so that I offset my accumulated harvested capital losses from previous years.

In order to get a given amount of income from capital gains, you need to sell more than that value of stock. For example, suppose you have a stock that you bought at $25 a share and that now is worth $60 a share. Suppose you want $2000 of extra income. The per-share capital-gain amount is $60 - $25 = $35. So you need to sell $2000 / $35 per share = 57.1 shares (which you might round up to 58 shares). That is, you'd sell 58 * $60 = $3480 in stock value.